Building an outbound sales motion

Comments Off on Building an outbound sales motionThis is the third in a series of articles based on “Crane Foundations”, an instructor-led course on how to build founder-led go-to-market, originally created for early stage B2B companies in the Crane portfolio.

Introduction

As a founder, a strong indicator that the time is right to start testing an outbound sales campaign is when you are unable to generate enough opportunities from either your inbound leads or your bottom up motion

Defining “who”

The first step when embarking on any outbound sales campaign is to define your target market.

This is a list of companies and individuals that you want to get meetings with so you can try and validate your Ideal Customer Profile hypotheses.

Including companies of different sizes in your target market is a good idea as it helps with this validation and also maximises your chances of hitting your revenue goals.

Once you have compiled your initial list of companies, the next step is to identify potential Economic Buyers and Champions using something like the Miller Heiman model.

Aim to identify multiple people per company to get meetings with, with 200 to 400 individuals being a realistic amount to compile without needing much additional help.

A typical outbound campaign will contain a much larger number of individuals than 200 to 400, but for an initial outbound test, this number should be sufficient.

The campaign “how”

Having compiled your target market and the list of who you want to get a meeting with, the next step is to work out how to get in front of them.

This stage of an outbound campaign can be frustrating for founders as it often feels like they are hitting a brick wall of unresponsiveness. This is quite common, so the first type of outbound campaign we will look at is one designed to address this common frustration.

The power of introductions

The goal of an introduction campaign is to replace the brick wall of unresponsiveness by asking for introductions from people in your (and your co-founder’s) network who have direct connections to your targets, or at the very least to someone who might be able to get you in front of the target person.

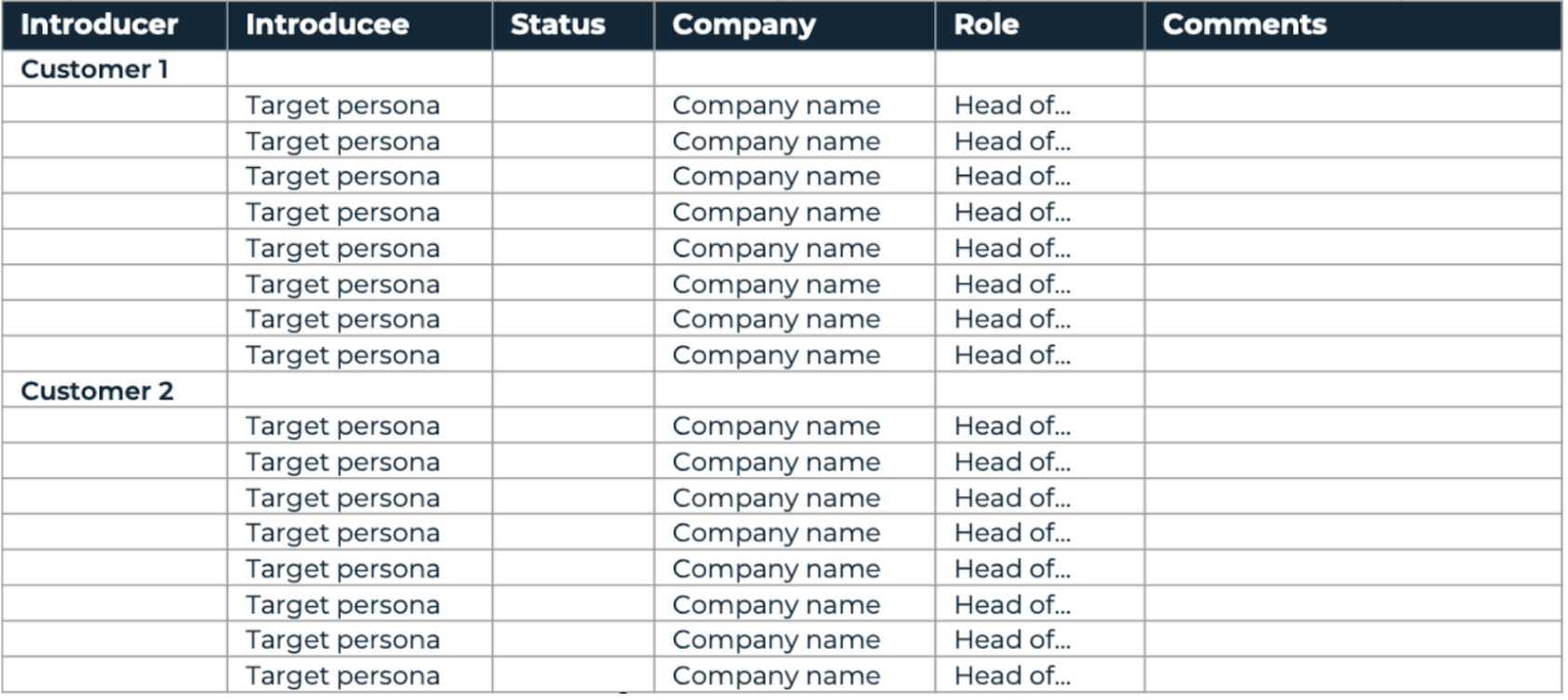

As with every other part of the sales process, getting an introduction needs to be a managed activity, with message personalisation and follow ups being tracked and measured. To make this more manageable you might want to consider starting with just the top 50 most important prospects from your target list.

Figure 1: Introduction Campaign tracking spreadsheet

Whilst it is by no means a “silver bullet”, an introduction campaign can be an effective shortcut to getting meetings with the right people and closing some early deals.

However, you should keep in mind the following tips to ensure that the campaign has the best chance of success –

- Ask for specific introductions from specific people. The main reason introduction campaigns fail is because founders ask potential introducers something broad like “do you know someone at this company or in this industry?”. The key to success is to ask for introductions from specific people to specific people. As you will likely be using LinkedIn for your preparatory work, keep in mind that potential introducers are often connected to people they do not really know so try to identify several people to ask for a particular introduction.

- Send them some sample text they can use. If someone in your network says that they can make an introduction for you, be sure to send them some sample text, making sure the text is clear about –

- What your ask is

- What the benefit would be for that person to speak with you

- Avoid filling the sample text with what you do. Instead, describe the problems you are looking to solve. Also ask the introducer to keep you copied (cc’d) into the introduction from the start.

- Keep the introducer in CC. If the prospect responds to the introduction, put the person who made the introduction into CC (not BCC) until the meeting has been booked. This may sound counterintuitive but our experience shows you will get better and quicker responses this way.

- Use use of your investors for introductions. Investors are often very well connected but underutilised by founders as a source of introductions. Using part of every board meeting to go through a list of introductions, allocating approximately 10 per investor can be very effective (so long as you make sure to follow up with them regularly).

- Ask existing customers for introductions. If you plan to ask any of your existing customers for an introduction then it is important to do this in person as these introductions are much more valuable but also more sensitive to ask for.

Example emails

The following example can be used as a template to ask for an introduction. Be sure to include LinkedIn profiles of the people you want introductions to to make things easier for the introducer –

Hi <name>,

I noticed you’re connected to the people below and I’m hoping you might be able to introduce me?

- Person 1 <LinkedIn profile link 1>

- Person 2 <LinkedIn profile link 2>

- etc…

We’re trying to get introduced to as many people in the roles as we can to ask them for 15 minutes of their time to get feedback on what we’re building.

Do you think you’d be able to make an intro to any of these people? I can provide some text about us if you’re happy to make any intros.

Many thanks

Example email 1: Asking for an introduction

If they are open to making the introduction for you, you can then send them something like the following. Again, make sure it is not a description of what you do, but is a succinct and compelling summary of the business value you deliver to the person you want to meet with.

Hi XXX,

I hope you’re doing well.

One of the companies I work with / <or description of how you know them> has asked if I can make an introduction to you.

They have a solution in your space aimed at solving <problem X> and delivering <value Y> and would like to get some feedback on it – they’re asking for 15 minutes of your time.

I thought you might find it interesting to hear about what they do and have included a short paragraph describing it below.

Let me know if that would work for you?

Many thanks

<<DETAILS OF VALUE YOU DELIVER TO THIS PERSONA>>

Example email 2: Sample text for your introducer

Introductions tend to deliver much higher rates of meetings than any other outreach method so it is worth trying to drive as much value out of your and your co-founder’s networks as you possibly can.

Cold outreach

A cold outreach campaign is when you are trying to reach people that you do not have any connection with.

Email, LinkedIn, webinars, events, direct mail, online communities and phone calls are just some of the myriad of channels available for cold outreach.

We will focus on two of the most common and readily accessible ones for this kind of campaign – email and LinkedIn, but you should expect that a given person will need several prompts across a number of different channels before they respond.

Regardless of the channel and number of prompts, the most important thing for making any cold outreach campaign successful is personalisation.

Keeping it personal (emails)

When crafting a personalised cold outreach email, keep the following tips in mind to maximise your chances of getting a meeting –

- Subject line. Personalisation begins with the email’s subject line. If your recipients do not like the email subject they are very unlikely to open your email. There is no way of telling what subject line will work until you start testing options so it is important to be able to measure email open rates using platforms like Hubspot, Apollo, Salesloft, Outreach etc . Ideally, you are looking for a minimum open rate of 50%, with 60% or above being ideal.

- Emails with generic subject lines tend to get deleted without being opened, so personalising it to the particular persona and keeping it short (5 to 6 words at most) tends to lead to better results, as does picking out a short phrase from the body of your email and using it as the subject.

- Email body. As with the subject line, everything about the body of your email needs to be tested and iterated on to find what really works. The following guidelines perform consistently well and should help you to get started –

- Keep the email to 3 short paragraphs followed by a clear call to action

- Get to the point quickly and keep the total length of the email to 150 words or less

- Paragraph 1. Many email clients preview the first few lines of an email, so your opening paragraph, together with the subject line, has additional work to do in order to get their full attention such that they open and read the entire email.

The best way to get their attention is to personalise the opening paragraph to the specific person you are contacting. However, try and avoid this form of generic personalisation –

Hi <name>

I can see that you’re <Role> in <Company Name> so I’m sure you care a lot about <This Problem>.

This type of opening paragraph will likely result in no replies (and may very well end up getting filtered as spam). Instead, try to focus on creating something truly personal to the recipient –

Hi <name>,

Congratulations on the merger with ACME. You and William have built a great company and it’s good to see XXXX becoming the largest <their industry> company in Europe.

This type of personalised first paragraph has clearly been written specifically for the recipient and demonstrates the sender has done some research about them and the company they work for.

- Paragraph 2. If the first paragraph is designed to get your prospect’s attention, then the second paragraph has to tell them what is in it for them.

You can do this either by highlighting the pain that you solve or by showing the value you provide to the person you are emailing.

Again, this should not be a description of what your company does, it should be what’s in it for them specifically to engage with you further in order to find out more.

- Paragraph 3 is about showing the relevance to them and their company along with some “social proof” – real examples of the value you provide that demonstrate you can deliver what you say you do.

- Call to Action (CTA). The final part of the email should be a clear call to action which in most cases will be a request for a quick call.

Tying it all together

Subject: Your Recent Merger With ACME

Hi <Name>,

Congratulations on the merger with ACME. You and William have built a great company and it’s good to see <their company> becoming the largest <their industry> company in Europe.

When I talk to operations leaders like you, there is one question that ALWAYS comes up: how do I make sure that all my onboarding, claims and maintenance processes are on track and completed on time, with excellence?

I’m asking because we recently helped <competitor>, in the first month, to automate 9 out of 10 steps of what used to be an entirely manual process, dramatically decreasing turnover time and improving the quality of their operations.

Do you have 15 minutes to explore this further in the next week?

Example email 3: a good personalised outreach email

Personalisation and outreach volume are inversely proportional, so this level of personalisation should ideally take no more than 5 – 10 minutes per email, otherwise you will not be able to send enough emails to be effective.

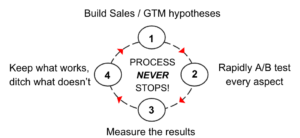

It is also why it is important to continually run rapid iterative outbound tests to identify the right level of personalisation and message content that delivers the greatest response rates with the minimum of effort.

Keeping it personal (LinkedIn)

In our previous article on managing inbound sales we recommended sending LinkedIn connection requests without a note.

Although this sounds counterintuitive, especially in light of the importance of personalising messages, we generally see higher acceptance rates when the connection request does not contain any additional information.

If the connection request is accepted, then the same personalisation for emails applies to your follow-up message and, as with emails, if the follow up message is not relevant to the person or their role you are unlikely to get any responses.

Personalisation is more challenging with LinkedIn as your message needs to be very short, ideally no more than 50 words (or about a third of the length recommended for a personalised email).

This is why you may want to consider experimenting with LinkedIn Voice Notes and include a 30 second voice recording to your outreach sequence for your follow up message.

Cadence

Whether you are running an introduction campaign or doing cold outreach, it is important to define what your outreach sequence or cadence will look like.

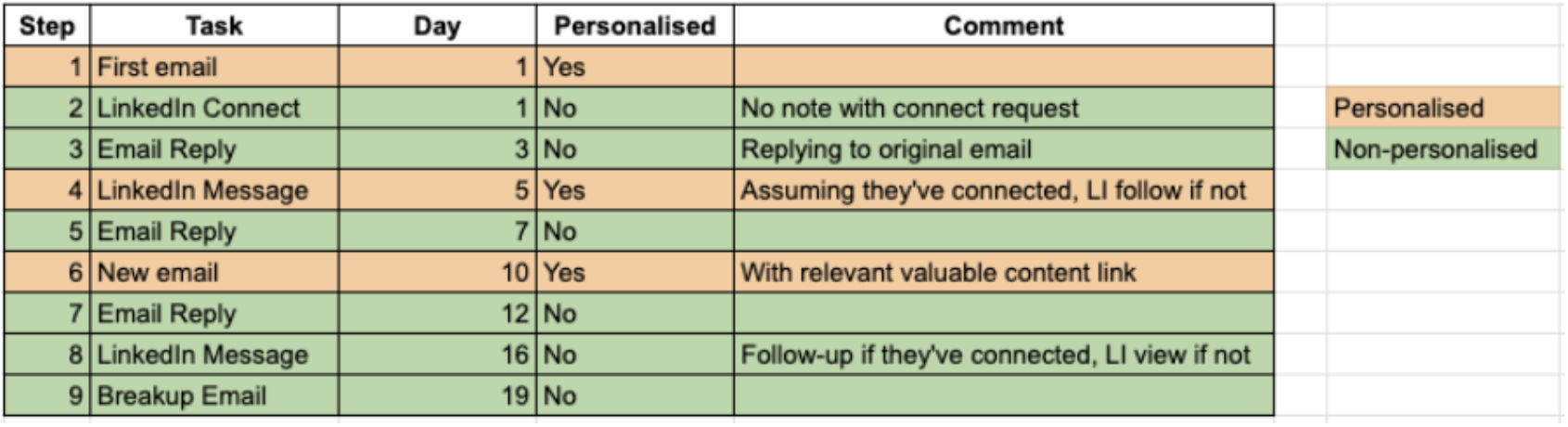

The “Agoge” sequence pioneered by Sam Nelson is a great way to track your outreach cadence as it is designed to maximise your response rate while minimising the personalisation work required.

Figure 2: A reduced Agoge sequence

A full Agoge sequence includes 15 outreaches or “touches” over a period of 27 days so is best suited to larger companies that have dedicated lead generation teams.

A reduced Agoge sequence like the one in Figure 2 is therefore much more appropriate for an earlier stage business as it only requires 3 personalised messages, two of which can be based on the research conducted for the first personalised email in the sequence.

There is no ideal outreach cadence, so just as with every other aspect of running an outbound campaign, as a founder you will need to track and test different aspects to see what works. For example, over time you may realise that you need to have different sequences for different priority prospects.

Metrics that matter

For any personalised outreach, founders should aim for an average open rate of over 50%. Anything below indicates you need to start testing different subject lines or the initial 10 to 20 words of the first paragraph.

If you are seeing open rates of 20% or lower, then it is highly likely that some of your emails are getting filtered as Spam.

In terms of getting responses to your personalised outreach, a response rate per sequence of over 10% (with the majority of these being positive responses) and a meetings booked average of over 5% per sequence is what you should be aiming for.

And to reiterate, in order to get anywhere close to these metrics you will need to personalise your messages and use multiple channels.

A final word: enrichment

Once you have compiled your initial target market and identified an initial 200 to 400 people, you may need to do some additional enrichment to gather more complete information about them to support your personalisation efforts.

Tools like Zoominfo, Cognism, Apollo, Lusha and Hunter along with a multitude of others are available, all at various different price points. Our experience has been that a single tool is rarely enough and a combination is usually required to get a complete set of information about your potential prospects.