The 4 steps to managing inbound sales

Comments Off on The 4 steps to managing inbound sales

Ben Wright on the 4 stages of managing your inbound sales motion

This is the second in a series of articles based on “Crane Foundations”, an instructor-led course on how to build founder-led go-to-market, originally created for early stage B2B companies in the Crane portfolio.

Introduction

As a founder you will almost certainly need to employ a variety of different sales motions throughout the lifetime of your start-up, so in this and the following article in this series we will be covering how to manage the most common ones, starting with an inbound sales motion.

Sales repeatability recap

In our previous article we covered why, regardless of whatever sales motion you adopt, the key to sales repeatability lies in a founder being able to identify an initial beachhead ICP market.

As you embark on finding this market and establishing your initial go-to-market motion, you can be fairly certain that any early hypotheses you have developed on who is most likely to buy from you and be successful will either be partially or completely wrong.

This is very common and part of the normal process of establishing product market fit.

It is also the reason why, as a founder, it is important to embrace the idea that identifying markets that you can sell into successfully is a never ending process of iterative testing.

Even if you happen to get lucky and establish some early sales repeatability, it is very unlikely that that initial motion will work the same way in six or twelve months’ time because as your start-up evolves, so does the market.

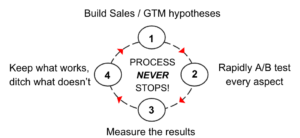

This is why the process and steps described in Figure 1 continue to apply even when you scale to tens of millions in revenue.

Figure 1: The continuous iterative process of testing markets

- Step 1: You develop a hypothesis about who is most likely to buy from you and test it by getting as many meetings as possible with prospective customers.

- Step 2: You test every part of this hypothesis rapidly, from your outreach messages and communication channels, call scripts, meeting agendas, discovery questions, demos, stakeholder engagement, value proposition etc.

- Step 3: You rigorously measure the effectiveness (or not) of every aspect of your testing, such as email open and response rates, the number of meetings booked, through to the number of demos delivered, how you have gained access (or not) to important stakeholders and ultimately the number of won and lost deals.

- Step 4: You review what you’ve learned, keeping what works, and stopping what doesn’t and then go back to Step 1 to begin testing your next hypothesis.

And most importantly, you should embed this process into the way you operate right now, even if you are the only person doing the work, because it will ensure that your Go-To-Market (GTM) motion continues to be fit for purpose as you scale.

The goal of every sales motion

Whatever sales motion you begin with or adopt over time, the goal of each of them is the same: to generate meaningful revenue*, with the first and most important step to achieving this goal being to secure meetings with the right people.

Personas

As a founder, you are likely to encounter a variety of different people or personas in your sales meetings, so being able to identify them and understand their role in the buying process maximises your chances of securing meaningful revenue.

Understanding buyer personas also helps make effective use of your (and their) time and effort.

The Miller Heiman model provides a simple way to categorise four key personas you are likely to encounter in these meetings –

- Economic buyer (EB) – this is the person who actually owns the budget to pay for your solution and will normally have the final sign off. The level in the organisation hierarchy where you will find your Economic Buyer depends on the price of your solution, as budgetary sign-off authority varies from level to level, and from company to company. A common mistake is to assume that the person you are speaking to in a sales cycle is an Economic Buyer, when the true EB is actually higher up in the management hierarchy.

- Champion (C) – a Champion is not just someone who is enthusiastic and will advocate for purchasing your solution, they also need to have sufficient authority and / or influence to get you in front of the Economic Buyer. Your goal when meeting potential Champions is to build trust by helping them understand the value you can bring to their company, department and to them individually. If done correctly, they will become a Champion and actively advocate for your solution internally, bringing or introducing you to the right people. Common pitfalls to avoid are believing your Champion is the Economic Buyer when in reality it is likely to be their boss (or even their boss’s boss), and to assume their enthusiasm means they also have the necessary authority or influence.

- User Buyer (UB) – this is typically the person or group of people who will use your solution day to day and evaluate it based on their user experience. User Buyers often contact you directly (“come inbound”) as they are actively looking for something which makes their own work easier. If you offer an open source, freemium or free trial version of your solution it will invariably be User Buyers that download it or sign up. A common pitfall with User Buyers is to mistake them for a Champion because they are often very enthusiastic about your solution. No matter how much they love what you do, if they lack the authority or influence to help you navigate the business and get in front of the Economic Buyer, they cannot be considered a Champion. User buyers are also the persona most likely to visit your website and although you will have to work hard to navigate from them to a Champion and then to an Economic Buyer, engaging them can often be a great source of learning and information for you (assuming they are willing and able to introduce you to a potential Champion).

- Technical Buyer (TB) – this person or group evaluates whether it is feasible or safe to implement your solution. They can be from IT or Information Security, or could also be from Legal, Finance or Procurement. A Technical Buyer could veto the purchase of your solution for any number of reasons so it is important for you to understand who the Technical Buyers are and to engage them at the right time in the buying process.

Now that we have covered the kinds of personas you are likely to encounter in a sales process, for the remainder of this article we will take a look at managing an inbound sales motion**.

Capturing details

An inbound sales motion is one where prospective customers have contacted you, usually by interacting with your website in such a way that you are able to capture details about them and their company.

Downloading gated content, asking to be added to a waitlist, requesting a demo or signing up for a free trial are just some of the ways to capture details on inbound leads.

With your limited capacity and resources, capturing the following details allows you to efficiently prioritise inbound leads for further engagement, with any leads that are a match (or close match) to your ICP hypothesis being the highest priority –

- Name

- Company

- Work email address

- Phone number (optional)

Whilst most inbound leads will not leave their phone number, any that do are likely demonstrating that they have a high degree of interest in your solution. Once you have done some research on the person and their company, if they turn out to be a match or close match to your ICP, you should not hesitate in picking up the phone and speaking with them.

Also, depending on your solution you may also want to consider capturing their role and/or department, however it is the company they are from that is the most important detail needed for prioritisation, hence why you should mandate a work email address.

Without knowing what company they are from, it will be impossible for you to prioritise your inbound leads which increases your risk of spending precious time and effort on leads that are unlikely to yield any meaningful revenue.

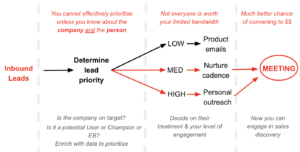

Figure 2 describes the flow and steps of a typical inbound sales motion with the ultimate goal being to maximise your chances of generating meaningful revenue by securing meetings with the right people.

Figure 2: Inbound lead to meeting flow

- Step 1: Examine the details captured to determine if their company is a match/close match for your ICP, and use the company and person’s name to determine their role, using the Miller Heiman model to categorise them as either a User Buyer, Champion, Technical Buyer or potential Economic Buyer.

- Step 2: Having compared the inbound lead to your criteria for an ideal company and persona, triage it into High, Medium or Low priority.

- Step 3: For anyone you have determined to be a low priority lead you can send them an automated sequence of emails focused on helping them get the most out of your solution. If they have signed up for a free version or free trial then directing them to more online content may work better then sending emails. Low priority leads might include people you cannot identify or people who work at companies that are not a fit for your solution.

Medium priority leads could be people from a company that matches your ICP but the person is not necessarily your ideal persona. In this case putting them into an automated “nurture” sequence of emails and LinkedIn messages where you send them product details interspersed with an occasional personal outreach asking if a meeting might be of interest works well. If you do not have many high priority leads it is also worth considering doing a more personalised outreach instead.

High priority leads are a match/close match to your ICP. If you offer a free signup or download, check to see if other people from the same company have also signed up / downloaded as that could be an indication that a broader evaluation of your solution is taking place. Regardless, for anything you have determined to be high priority, you should spend some time researching the company, person and any mutual connections so you can send them a highly personalised outreach email or LinkedIn message suggesting a meeting. You also want to reach out to them as quickly as possible because there is a strong chance they will also be looking at your competitors and the company that engages with them first will often set the agenda for everyone else.

If your volume of inbound leads is low you may want to consider a broader set of prioritisation criteria to optimise for more meetings.

Conversely, if you have a high volume of inbound leads you should consider stricter prioritisation criteria to make the best use of your limited time and resources.

The important thing to note is that the key to making an inbound sales motion work is to have a clear strategy for how you want to prioritise, categorise and engage with each inbound lead.

Personalisation

The goal with high priority inbound leads is to engage them in a meeting for deeper sales discovery, so it is important to reach out to them with a highly personalised message as quickly as possible (within 2 hours is a good target to aim for).

Research their company and the person and try to find something that will demonstrate your request for a meeting is not a generic message, and that you are a real person reaching out to them specifically.

If you offer a free trial or freemium product that they have already signed up for, then including some details on their usage can also be a very helpful way to personalise your message.

You should also consider using a variety of different channels to engage your high priority leads. As previously mentioned, if they have provided a phone number then you should aim to call them right away, otherwise connecting and messaging them on LinkedIn as well as sending a sequence of personalised emails works well (counterintuitive tip: sending a LinkedIn connection request without a note tends to have a higher acceptance rate). If they accept your connection request, think about sending a LinkedIn voice note as part of your outreach as they are intrinsically personal and often very effective.

If you are targeting developers, emails are unlikely to be successful, but LinkedIn and engaging them in Slack or Discord developer forums should yield better results.

Even though they have “come inbound”, do not be surprised if it still takes multiple outreaches across different channels to elicit a response from high and medium priority leads (we recommend trying a minimum of 4 outreach attempts).

Depending on your volume of high and medium priority leads, multiple outreaches across multiple channels could be a lot of work so if you are getting a 100+ high priority inbound leads a month, engaging a team member or hiring an intern to help filter or “rinse” the inbound leads can work very well.

The important thing to remember if you elicit someone’s help is that any outreach must look like it is coming from you the founder, so you should consider setting up an additional email account and grant them access to your LinkedIn to send messages on your behalf – just remember to always approve the content they are sending.

Summary

In the next article in this series we will look at building and managing an outbound sales motion along with examples of effective outreach messages, but for now, the four key steps to successfully manage an inbound sales motion are –

- Capture: as much as detail as you can about your inbound lead

- Compare: that detail to your ideal customer profile

- Prioritise: triage, prioritise and engage each inbound lead based on a clear strategy

- Personalise: research your high priority leads and reach out to them quickly with a highly personalised sequence of messages across multiple channels

__________________________

*Meaningful revenue = in the tens or hundreds of thousands per deal

** An outbound sales motion will be covered in the next article in this series